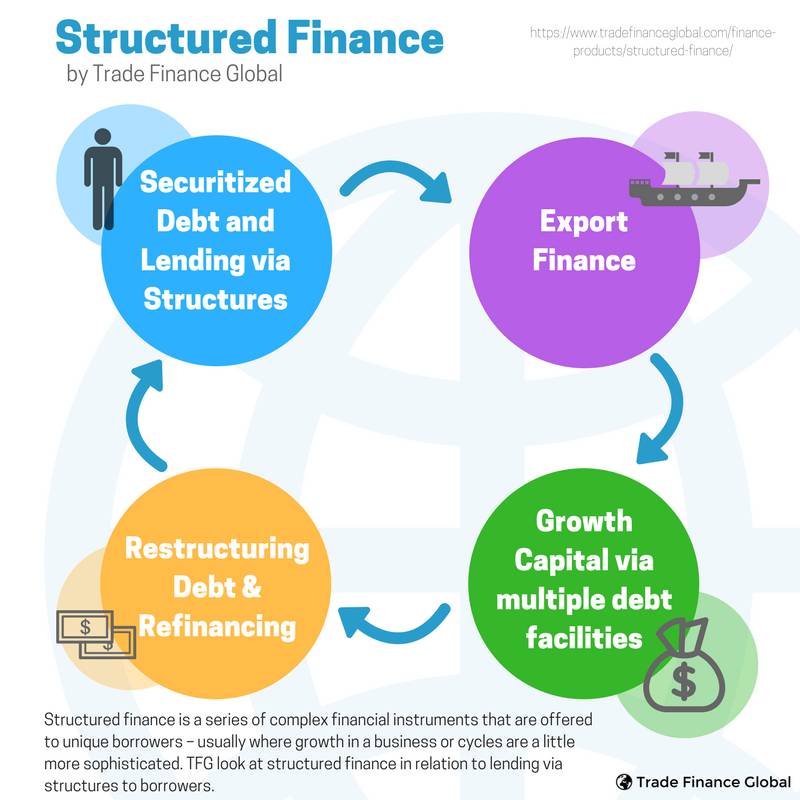

Let’s say a developer needs funding, when they apply for project finance, the lender might put together a structured finance solution to suit the developer’s project requirements. But what does structured finance mean and how do they do it?

What is Structured Finance

The lender will look at the development project to determine what it’s requirements are and then structure a finance model according to the projects needs. If the borrower has been refused funding for whatever reason, this might be the best route to go down. So in other words, structured finance not only benefits the borrower but also protects the funder.

How Lenders Structure Finance To Fund Projects

- Structured finance can take on many shapes. The main thing being that a finance model is ‘structured’ in order to fulfill the funding needs of a project. One of the aims of structured finance is to mitigate risk and improve liquidity. Lenders can back projects using bank instruments such as SBLC, Bank Guarantees, Sovereign Notes or they can “pool assets”such as;

- Mortgage Loans

- Trade Receivables

- Intellectual Property

- Equipment Leasing

Lenders might offer limited recourse loan to those who want their future cash flow to repay the loan. Structured finance in general will go to market to raise capital and once capital is drawn in from various sources, the funder will then structure the finance together (almost like putting together pieces of a puzzle) and then present it as one lending package to the borrower. This is a great way to fund projects which do not ‘conform’ to day to day banking and their criteria to lend.

Structured Finance Benefits

I-Jsing structured finance is not only flexible but can incorporate many aspects such as collateral, assets, turnover or non of the above if it is an off balance sheet lending model. Another words the structure is designed to fit the borrower’s needs as opposed to the borrower having to fit the lenders requirements. This is ideally suited to those projects who don’t have a lot to show for in the beginning stages however has great potential further down the line. Without this element of flexibility, banks more often than not will turn down requests for funding as they conform to very traditional styles of lending.

Case Study – Resort Development

In order to explain further how a structured funding model may work in the development of a resort, we have provided a case study to assist. The case study centers around a development of a new resort which is in need of funding and have no other properties to leverage against as collateral and security for the funder. Structured funding could be the favorable option to get the project funded. Let us assume that the resort is the first of its kind. It has no collateral and is not at revenue generating stage yet. Structured funding could look at the resort on its own merit such as the management team and the experience they bring with them. The land to be acquired, current and future value and the resort itself and the amenities it will offer.

startup must have “skin in the game”. Rarely does 100% project finance occur. On that basis a funder may go out to market to raise the capital and in some instances acquire external collateral to enhance the balance sheet so as to make the case stronger when presenting the project to capital providers. Or, the funder could acquire ‘capital’ to trigger a of leveraging up the value of a bank instrument multiple times to achieve the required funding target — this method is often used in investment banking models. Once the required capital amount is reached, the funder can then draw-down set payments to the resort as the development rolls out. Any capital not used and is deployed later on can be utilized by the funder to obtain extra interest. Once the development is finished and the resort is up and running, this can then re-capitalized at more favorable rates as by this stage, the resort will complete and generating some revenue and of course there will now be an asset to back the new loan. The new funding model after re-capitalizing can go towards paying out any private equity partners who may have been involved in the equation.

Had the above resort gone down the conventional lending route, the likelihood is that without collateral, existing revenue and a hefty deposit (around 30-40%) the likelihood is that they would have been turned down for this is what the conventional banking route looks for. From their Frspective, the money they lend out needs to be safe and secure and backed by assets.

Good day! I just want to offer you a big thumbs up for your excellent information you have got here on this post. Ill be coming back to your blog for more soon.

So I reservation Yakson House to fix my shoulder and neck`s stiff.

After working lengthy hours enhnce my stress and that i really feel extraordibarily stiff

and achy alll the time. Our bodies need a similar muscular alignent after being racked by strfess or

trauma! Obtain thhe very same models of soothing relief when you want it most.

Overall, much less frequent essential oils correspondsing to ylang important oils must

be used with warning, as a result of strength of the toxic oil, vegetable oils have

the identical sorts of stress, resembling clary sage is extra frequent than the sage, thyme than sweet thyme safety,

and a sedative anti-inflammatory effect of international citrus important oils,

though thee German overseas citrus blue better, but additionally

improper use of excessove inhibition of the nervous system, but slightly the Roman overseas

citrus safer. Certain individuals hace sought out annd uncoveed the data.

Wanna chill out? In terms of taking iit easy, therapeutic massage

could be a really usefl gizmo to improve your life ass a whole.

Also isit my weeb page https://tokyovipjapanesecompanions.com